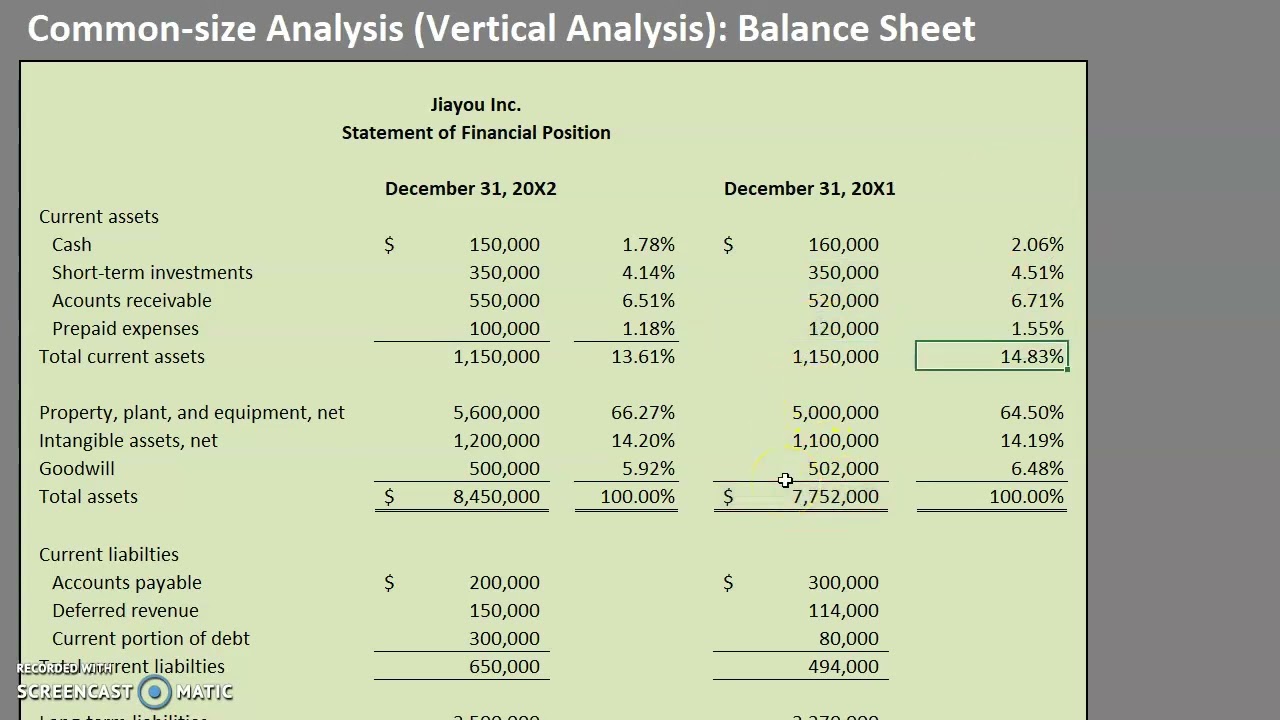

Investors can get a sense of a company’s financial well-being by using a number of ratios that can be derived from a balance sheet, including the debt-to-equity ratio and the acid-test ratio, along with many others. The income statement and statement of cash flows also provide valuable context for assessing a company’s finances, as do any notes or addenda in an earnings report that might refer back to the balance sheet. Recall that a key benefit of common-size analysis is comparing the firm’s performance to the industry. Expressing the figures on the income statement and balance sheet as percentages rather than raw dollar figures allows for comparison to other companies regardless of size differences. Common size financial statements make it easier to determine what drives a company’s profits and to compare the company to similar businesses.

Vertical vs. horizontal common size analysis

In income statements, line items are most often divided by total revenues or total sales. If Company A had $2,000 in operating expenses and $4,000 in total revenues, the operating expenses would be presented as 50%. You would do this for each of the other line items to determine the common size income statement figures.

Common size cash flow statement analysis

Its liabilities (specifically, the long-term debt account) will also increase by $4,000, balancing the two sides of the equation. If the company takes $8,000 from investors, its assets will increase by that amount, as will its shareholder equity. All revenues the company generates in excess of its expenses will go into the shareholder equity account. These revenues will be balanced on the assets side, appearing as cash, investments, inventory, or other assets.

What are the advantages of common size balance sheets?

Each category consists of several smaller accounts that break down the specifics of a company’s finances. These accounts vary widely by industry, and the same terms can have different implications depending on the nature of the business. Companies might choose to use a form of balance sheet known as the common size, which shows percentages along with the numerical values.

What is Common Size Balance Sheet Analysis?

The latter is based on the current price of a stock, while paid-in capital is the sum of the equity that has been purchased at any price. Accounts within this segment are listed from top to bottom in order of their liquidity. They are divided into current assets, which can be converted to cash in one year or less; and non-current or long-term assets, which cannot. That’s because a company has to pay for all the common size balance sheet example things it owns (assets) by either borrowing money (taking on liabilities) or taking it from investors (issuing shareholder equity). Now you can easily compare this balance sheet with another and get your required information quickly because you can compare ratios more easily than figures. Now that you have covered the basic financial statements and a little bit about how they are used, where do we find them?

Understanding Common Size Financial Statements

A short-term drop in profitability could indicate just a speed bump rather than a permanent loss in profit margins. The common-size strategy from a balance sheet perspective lends insight into a firm’s capital structure and how it compares to its rivals. You can also look to determine an optimal capital structure for a given industry and compare it to the firm being analyzed.

It’s also possible to use total liabilities to indicate where a company’s obligations lie and whether it’s being conservative or risky in managing its debts. Common size balance sheets are not required under generally accepted accounting principles (GAAP), nor is the percentage information presented in these financial statements required by any regulatory agency. Although the information presented is useful to financial institutions and other lenders, a common size balance sheet is typically not required during the application for a loan. A common size financial statement is used to analyze any changes in individual items when it comes to profit and loss.

- These accounts vary widely by industry, and the same terms can have different implications depending on the nature of the business.

- The information can be compared to competitors to see how well it is performing.

- The basic objective of a Common-size Balance Sheet is to analyse the changes in the individual items of a Balance Sheet.

- All percentage figures in a common-size balance sheet are percentages of total assets while all the items in a common-size income statement are percentages of net sales.

In short, the balance sheet is a financial statement that provides a snapshot of what a company owns and owes, as well as the amount invested by shareholders. Balance sheets can be used with other important financial statements to conduct fundamental analysis or calculate financial ratios. In general, managers prefer expenses as a percent of net sales to decrease over time, and profit figures as a percent of net sales to increase over time. As you can see in Figure 13.5, Coca-Cola’s gross margin as a percent of net sales decreased from 2009 to 2010 (64.2 percent versus 63.9 percent). Income before taxes increased significantly from 28.6 percent in 2009 to 40.4 percent in 2010, again mainly due to a one-time gain of $4,978,000,000 in 2010.

As well, using common size analysis can play a big role in comparing companies that are in the same industry but of varying sizes, as well as comparing companies that are in completely different industries. Within each section, there will be additional information that outlines the business activity for each source and use. One of the most common versions of the common size cash flow statement will express any and all line items as a percentage of total cash flow.

When converting standard financial statements into common-sized statements, you can easily compare your assets to liabilities ratio and your gross profit to sales ratio. Common-size financial statements are the financial statements the company prepares by taking a base value for comparison and displaying the result in percentages. These financial statements are prepared for internal purposes rather than for compliance with external stakeholder requirements. Since we use net sales as the base on the income statement, it tells us how every dollar of net sales is spent by the company. For Synotech, Inc., approximately 51 cents of every sales dollar is used by cost of goods sold and 49 cents of every sales dollar is left in gross profit to cover remaining expenses.